How Banks Can Strategically Counter the FinTech Disruption in 2023 and Beyond

Introduction

According to KPMG Pulse of FinTech H1'22, the global FinTech funding in the first half of 2022 was evaluated at U.S. $107.8 B. Moreover, the funding has slowed down considerably in Q3 2022, and this appears like the beginning of the autumn season for FinTech investors.

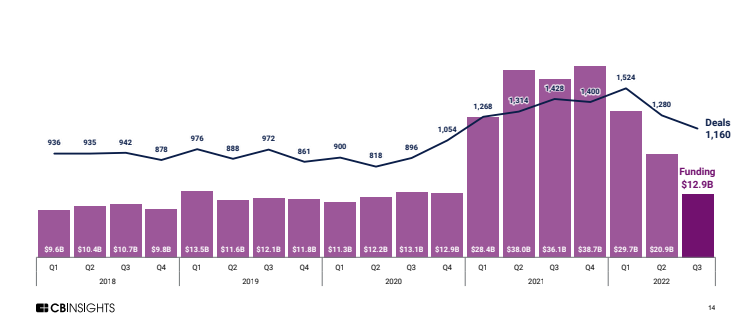

According to C.B. Insights, FinTech fundings in Q3'2022 dropped by 64% year-over-year (YoY) to $12.98 B, the lowest since Q4'20. Nonetheless, the road to 2023 doesn't still look promising for FinTech. Forbes has predicted that although 2023 funding may not rival 2021 growth, FinTech will continue to be a top priority for V.C. investments. In this blog post, we will explore how banks can strategically counter the FinTech disruption in 2023 and beyond.

The global Fintech market is anticipated to reach $225.1 B by 2027 at a CAGR of 12.9%.

So, what does this growth in FinTech investment mean for banks and credit unions? In the U.S., in particular, as FinTech raises large levels of funding, banks and credit unions are no longer the primary financial service providers. The FinTech venture market is far more overbearing and superfluous as compared to that of the banks and credit unions, so much so that it echoes and reflects on the trends of the venture capital market itself.

Since the inception of 2020, the percentage of Gen Z, Millennial, and Gen X customers in the United States that consider a digital bank like Chime, Cash App, or PayPal to be their primary checking account provider has increased tremendously. The obvious catalyst for this boost is digital transformation. Digital transformation propelled the creation of digitally native financial products and experiences by rearchitecting technology and revamping the processes.

Strategic Moves that Banks Must Make for a Winning Edge Over FinTech Companies

Unlike FinTech, banks and credit unions haven’t been receptive to achieving digital transformation. Fighting back against FinTech necessities the banks to embrace digital transformation. While partnering with the FinTech firms seems the easiest way out for the banks, fighting back may essentially require the banks and credit unions to carefully pick their battles. Let's choose the latter scenario as an agenda for discussion in this blog. How can banks strategically counter FinTech disruption in the year 2023 and beyond besides banking the opportunities for mutual collaboration with the FinTech firms:

1. Overdraft

When more money is removed from a current account than is available, an overdraft arises. This can be money in a bank account in financial systems. It could be groundwater in an aquifer for water supplies. The account is "overdrawn" in these circumstances.

U.S. neobanks have mandated fee-free draft protection to be a central and highly visible product feature. Since U.S. banks collected $15.47 billion in overdraft and non-sufficient funds (NSF) back in 2019, this feature provides a significant competitive advantage to the neobanks.

This leaves banks with a great strategic threat. Generating significant revenue from overdraft and NSF fees has become competitively and regulatorily unsustainable for the banks. To tackle this challenge, some banks, such as Capital One, have eliminated overdraft and NSF fees and are still offering overdraft protection to qualifying customers. Other banks like PNC are architecting new features to help customers avoid accidental drafts more easily.

Banks can use this shift to differentiate themselves from commodity to a space where they can meaningfully differentiate based on a data-driven approach that can be incorporated into the underwriting to provide a competitive advantage. This shift presents impeccable opportunities for banks that are ready for the changes and exceptionally good at underwriting short-term customer credit.

2. Saving & Investing

FinTech companies are majorly helping customers in two ways, setting aside money for saving and assisting customers in earning the best possible yield on that money (within their risk thresholds).

The FinTech companies that are gaining the maximum amount of traction with the customers are unifying these two crucial tasks to provide an integrated and streamlined experience.

The threat posed by FinTech savings and investment apps for the banks comes from the potential that these apps provide to wrest control over the allocation decisions that fund those products.

During modern times, most banks are either equipped with automated savings capabilities or are launching them, keeping in view the proliferation of the embedded financial service and banking-as-a-service space. Personal Finance Management (PFM), basic automated savings, and money movement capabilities are table stakes for banks, and if they don't possess them, they can easily get them through any core banking provider. However, since only a small percentage of customers in the U.S. often use automated savings tools from their banks and credit unions, there's clearly an immense scope for growth that's needed.

Banks must start by refining the experience and insights offered by their savings tools. Doing a simple act like pulling all information from customers' accounts into one number that can be shown to the customers can be beneficial. Also, a major challenge for the banks remains to figure out how to serve seamless, ideal experiences to lower-income customers within emerging economies.

Another primary focus for banks can be blending savings and investing together. Automating the process of setting money aside can be useful to customers, but in a low-rate environment, if banks fail to offer an array of different yield-generating investment opportunities to the customers across an array of risk spectrums, then they can't be considered a competitive alternative to FinTech.

Enriching savings tools with more compelling opportunities to earn yield also require banks to be less nauseous (still conscious of the regulations, though) about new investment asset classes such as cryptocurrencies, a step that many banks still aren't willing to take.

3. Buy Now, Pay Later (BNPL)

In the wake of the COVID-19 pandemic, the percentage of GenZers making purchases using the BNPL plans grew exponentially. The use of BNPL by millennials also increased, and even Baby Boomers contributed.

BNPLs can pose a strategic threat to the bank as they can significantly improve the conversion rates and the average order value for customers without taking on excessive, long-term credit risk. These traits make BNPL extraordinarily popular among merchants and usually accessible as a mainstream credit product to customers across every credit score band, which makes it a dangerous competitor to banks' payment and unsecured lending products.

The most common product response from some of the most popular banks, such as American Express, is an incremental one: retroactive BNPL. This capability allows credit cardholders to retroactively convert large purchases, typically $100 or more, into a series of monthly installment payments for a small installment payment for a small additional fee or additional interest.

Bolting BNPL capabilities to credit cards retroactively is an appealing approach for banks as it preserves existing interest and interchange revenue streams and doesn't require them to build direct partnerships with individual merchants. It's a short-sighted approach for banks as the modern credit invisible customers are tomorrow's prime credit customers.

Many of these credit-invisible customers eventually become profitable prime banking customers, and the BNPL providers that helped them get there will have the inside track on earning and keeping their business in lending and beyond.

The customers of the banks need help using BNPL responsibly.

For instance, many of the BNPL users in the past have been making late payments. The predominant reason for these delays is losing track of when the bill was due rather than needing more money.

So, if banks want to acquire young customers if they neglect BNPL.

4. Niche Neobanks

The concept of niche neobanking leverages the need to find a specific segment of customers with similar functional and emotional needs related to money. Then custom financial products can be built for such customers. Later the products can be publicized among the existing groups and communities that these customers are a part of.

FinTech companies that follow this playbook style include Daylight (LGBTQ+ customers), Kinly (Black Customers), and Purple (Disabled customers) – and trading a smaller total addressable market (the universe of potential customers) for a more extensive service obtainable market (the share of that market that they can win with a differentiated product and distribution strategy).

Differentiated products can be less trivial strategic threats to banks on an individual level but more severe in an aggregate, as they enable neobanks to pick off a small portion of banks' customer bases in the aggregate.

A relatively meek and ineffective strategic response from banks to this trend was the creation of digital spin-offs that were designed to appeal to younger customers. Spin-offs posed the cannibalization threat and didn't ever receive the long-term resources and support to succeed.

To compete with niche neobanks, banks dramatically reduce the time and expense of launching new products. They must embrace product innovation and unlock agile product development ability. The banks can then search for specific customer segments with financial needs that are unmet or inadequately addressed and build products for their particular requirements.

5. Open Banking

Open banking is a core function of many FinTech apps and is a dominating trend in the modern FinTech market. Open banking allows customers to share data with other financial accounts and providers, enabling other products or experiences. With the proliferation of FinTech, the number of customers who have used open banking capabilities to fund new FinTech deposits or power their financial management insights has also increased.

Open banking poses a strategic threat to banks, who are imposing stringent regulatory norms on their customers, and the process is making it difficult for them to share data. Such banks are also risking their customer relationships.

Open banking is inevitable in the United States, and many banks have recognized this. They have started working with data aggregators to replace screen scraping – the method that has been used historically to access banking data using customers' account credentials with more secure and performant application programming interfaces (APIs).

Banks can start by building common standards and streamlining technical integrations as a necessary first step. The second crucial step is to leverage these APIs (and customers' willingness to allow access to their data) to build new products and services. Unfortunately, few banks are leveraging this strategy.

Wrap-Up: The Way Ahead for Banks

As the FinTech proliferation will increase in 2023 and beyond, building more comprehensive customer data points should be a priority for banks. Banks must ensure that they have a comprehensive view of their customers' financial behavior across all the providers with whom their customers choose to work with. The banking investment in more sophisticated risk-decisioning also remains pivotal. The bankers must sharpen their risk-decisioning capabilities by leveraging more comprehensive customer data to compete effectively. Banks must prioritize software development agility and must invest in structural changes to accelerate their software and product development cycles.

Banks must build for developers. For banks, their customers are new developers. Banks must modularize their customers' capabilities. They must design phenomenal and new-age experiences for their customers inside of banks and outside of it and must deliver these experiences inexpensively and quickly through cutting-edge products and services.

Banks should seize the opportunities to innovate amidst the FinTech disruptions. By adopting a competitive mindset only, the banks can improve their position in the market.

If you Liked This Article, Feel Free to Leave a Comment!

Subscribe to My Newsletter - 'The Awesomesauce Technology: All Authentic, Popular & Unpopular Opinions,' to Receive Latest Insights From Emerging-tech Luminaries For Free and Support My Work.